News

PVC, PP rose and fell, why? Ministry of Commerce: the United States imports of PA66 slices to continue to impose anti-dumping duties for 5 years

Release time:

2021-10-15 08:47

In the past two days, the plastic futures market has experienced a large-scale decline. Among the energy and chemical commodities, ethylene glycol and PVC have fallen by more than 7%, liquefied petroleum gas by more than 7%, methanol by more than 6%, styrene by more than 4%, and plastics and PP by more than 3.5.

PVC, PP and other plastic plate market ups and downs, ups and downs, so that many plastic people marvel "witness history".

Xiao Bian believes that the reasons for the big changes in the PVC (polyvinyl chloride) market are:

Affected by the price increase of calcium carbide and vinyl chloride: after the festival, for example, the average cost of PVC calcium carbide production enterprises increased by 1570 yuan/ton to 12800 yuan; The cost of ethylene method for external extraction of vinyl chloride increased by 2040 yuan/ton in about 12300 yuan;

Large-scale PVC force majeure events (overhaul, shutdown) in Europe;

The overall start-up situation of the industry is insufficient: PVC production enterprises as a whole start in 5-6%, some of the parking phenomenon. From the downstream point of view, most of them are affected by cost pressure, holidays, etc., the operating rate is weak.

Xiao Bian believes that the reasons for the big change in the PP (polypropylene) market are:

The operating rate is not high: since mid-September, the operating load of plastic weaving, BOPP and other industries has declined;

Strong short-term cost support: rising prices of thermal coal, methanol, propane and crude oil, with polyolefin producers on the PDH, CTO and MTO routes facing cost losses;

As well as in the face of high prices just need to buy, peak season characteristics are not obvious.

If so, why has it fallen sharply in the past two days?

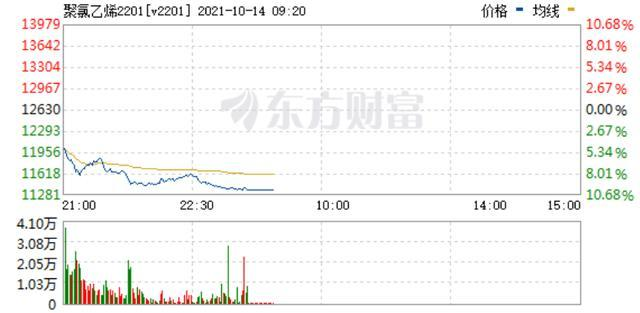

As of October 14, PVC futures staged a long-short double kill, plummeting 9.98, the reason may be: by the international market natural gas fell significantly coupled with the domestic coal supply news frequent impact.

Plastic futures prices have been down, PP, PE also fell across the board! Crude oil fell 1.4 per cent, PP PE fell nearly 3 per cent and ethylene glycol fell 5.79 per cent.

Industry insiders expect PVC and PP to continue to pull back in the future for no other reason: Shanxi, Inner Mongolia and other places work together to ensure the supply of coal, as well as the further implementation of relevant policies and measures such as easing power supply.

Within a few days, the PVC industry has a limit of trading and a limit of trading, which is really the king's flag of change at the head of the city!

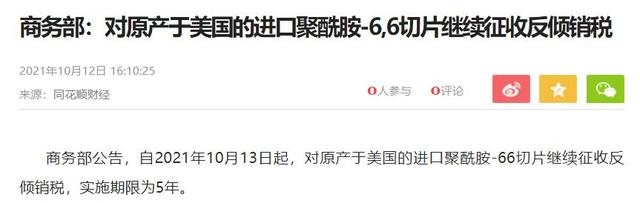

Ministry of Commerce: 5 years of anti-dumping duties on US imports of PA66 chips

The editor learned that the latest news on October 12, the Ministry of Commerce will continue to impose anti-dumping duties on imported PA66 slices originating in the United States for a period of 5 years. The new rates are as follows: Ascend Functional Materials Ltd. -31.4 per cent; Invista LLC -25.2 per cent; Other United States companies -37.5 per cent.

For PA66 anti-dumping tax increase, the domestic is not alone this year's case:

On October 12, 2009, the Ministry of Commerce issued Announcement No. 79 of 2009--

Decided to impose anti-dumping duties on imports of PA66 chips originating in the United States, Italy, Britain, France and Taiwan. The anti-dumping duty rates are 25.2-37.5 for American companies, 5.3-20.9 for Italian companies, 20.9 for British companies, 20.9 for French companies and 20.9 for Taiwan companies. The implementation period is 5 years from October 13, 2009.

On October 12, 2015, the Ministry of Commerce issued Announcement No. 37 of 2015--

Decided to continue to impose anti-dumping duties on imports of polyamide-6, 6 chips originating in the United States, Italy, France and Taiwan from October 13, 2015, and the implementation period is 5 years. The anti-dumping measures against imports of polyamide-6, 6 chips originating in the United Kingdom have expired.

On October 12, 2020, in response to the application of the polyamide-6, 6 chip industry in mainland China, the Ministry of Commerce issued Announcement No. 42 of 2020--

Decides to conduct a final review investigation of the anti-dumping measures applicable to imports of polyamide-6, 6 chips originating in the United States as of October 13, 2020. The anti-dumping measures against imports of polyamide-6, 6 chips originating in Italy, France and Taiwan have expired.

The editor believes that the Ministry of Commerce will investigate the possibility of dumping and damage to the PA66 slice industry in mainland China by imported PA66 slices originating in the United States if the anti-dumping measures are terminated.

Let's take a look at some plastic raw materials market trend analysis ~

1. general plastics market

PP: Continuation of weak tone

● Influencing factors ●

Futures continued to decline, suppressing the in stock market atmosphere, driving in stock prices to continue to fall, some petrochemical factory prices down, traders continue to lower quotations, market wait-and-see sentiment increased, downstream continued to be cautious to receive goods, real trading flat.

● Aftermarket Forecast ●

It is expected that today's domestic polypropylene market is weak finishing. Taking the price of wire drawing in East China as an example, the mainstream price of wire drawing is expected to be 9800-9900 yuan/ton.

PE: Price Decline

● Influencing factors ●

Some petrochemical plants continued to raise their stock prices, but the market prices fell. North China fell 150-250 yuan/ton linearly, high pressure fell 100-200 yuan/ton, low pressure fell 50-100 yuan/ton, wire drawing and injection molding fell 100 yuan/ton, and membrane materials fell 100-150 yuan/ton;

The linear part of East China region fell 150-300 yuan/ton, the high-pressure part fell 100-200 yuan/ton, and the low-pressure wire drawing, injection molding, membrane material and hollow part fell 50-100 yuan/ton;

South China region linearly fell 150-250 yuan/ton, high pressure fell 100-200 yuan/ton, low pressure wire drawing, hollow and membrane materials fell 100 yuan/ton.

Linear futures low open volatility repeatedly, petrochemical most stable, individual down or the introduction of batch policy, players trading confidence frustrated, holding the goods business report continues to loosen, the terminal factory more cautious wait-and-see, real price focus on negotiations.

● Aftermarket Forecast ●

It is expected that the domestic PE market price will drop slightly today, and the mainstream price of LLDPE is expected to be 9600-10150 yuan/ton.

ABS: Slightly Lower

● Influencing factors ●

Intraday energy and chemical commodities retreat, the mentality of the holders tend to be cautious, the mainstream market part of the negotiations loose, but small and medium-sized downstream factories to avoid the majority of risk, in stock transactions are not good. During the period, some middlemen prices were lower than first-hand merchants.

ABS mainstream ex-factory prices stabilized, manufacturers can sell in stock resources tight.

● Aftermarket Forecast ●

Short-term focus on just need to purchase rhythm changes, it is expected that the ABS market will be a narrow finishing operation in the near future.

PS: Falling prices

● Influencing factors ●

Raw material styrene prices fell, so that PS prices under pressure, and drag down the market trading atmosphere, downstream buying follow-up is not good.

● Aftermarket Forecast ●

Raw material styrene weak adjustment trend or continue, so that PS price pressure, some grades of supply tight or limit the decline, but the new production will land or form a drag on the price, the short-term PS price is expected to be weak adjustment.

PVC: price down

● Influencing factors ●

Upstream price offer, futures prices fell, but the market circulation of in stock is still not much, traders offer to follow the futures down. Terminal downstream low just need to replenish, intraday trading is light.

● Aftermarket Forecast ●

PVC fundamentals have not changed much in the near future, and the futures price trend has a more obvious impact on the in stock. It is expected that the short-term domestic PVC market will fluctuate, and the SG-5 oscillation range in East China will be 13600-14000 yuan/ton.

EVA: high finishing

● Influencing factors ●

Hard material offer slightly softer, soft material prices are relatively firm. Traders follow the market offer, inventory pressure is not great. The demand of terminal enterprises is flat, and the enthusiasm for entering the market is weak.

● Aftermarket Forecast ●

The fundamentals of market supply and demand have not changed much. EVA prices are expected to be adjusted in a narrow range, and VA18 content foaming materials may be 26500-29,000 yuan/ton. Pay close attention to the recent production scheduling of enterprises and the impact on EVA prices in the future.

Source: Looking for Plastic Viewpoint

Disclaimer: The above content is reproduced from WELINK Plastic, and the content does not represent the position of this platform.

In the past two days, the plastic futures market has experienced a large-scale decline. Among the energy and chemical commodities, ethylene glycol and PVC have fallen by more than 7%, liquefied petroleum gas by more than 7%, methanol by more than 6%, styrene by more than 4%, and plastics and PP by more than 3.5.

PVC, PP and other plastic plate market ups and downs, ups and downs, so that many plastic people marvel "witness history".

Xiao Bian believes that the reasons for the big changes in the PVC (polyvinyl chloride) market are:

Affected by the price increase of calcium carbide and vinyl chloride: after the festival, for example, the average cost of PVC calcium carbide production enterprises increased by 1570 yuan/ton to 12800 yuan; The cost of ethylene method for external extraction of vinyl chloride increased by 2040 yuan/ton in about 12300 yuan;

Large-scale PVC force majeure events (overhaul, shutdown) in Europe;

The overall start-up situation of the industry is insufficient: PVC production enterprises as a whole start in 5-6%, some of the parking phenomenon. From the downstream point of view, most of them are affected by cost pressure, holidays, etc., the operating rate is weak.

Xiao Bian believes that the reasons for the big change in the PP (polypropylene) market are:

The operating rate is not high: since mid-September, the operating load of plastic weaving, BOPP and other industries has declined;

Strong short-term cost support: rising prices of thermal coal, methanol, propane and crude oil, with polyolefin producers on the PDH, CTO and MTO routes facing cost losses;

As well as in the face of high prices just need to buy, peak season characteristics are not obvious.

If so, why has it fallen sharply in the past two days?

As of October 14, PVC futures staged a long-short double kill, plummeting 9.98, the reason may be: by the international market natural gas fell significantly coupled with the domestic coal supply news frequent impact.

Plastic futures prices have been down, PP, PE also fell across the board! Crude oil fell 1.4 per cent, PP PE fell nearly 3 per cent and ethylene glycol fell 5.79 per cent.

Industry insiders expect PVC and PP to continue to pull back in the future for no other reason: Shanxi, Inner Mongolia and other places work together to ensure the supply of coal, as well as the further implementation of relevant policies and measures such as easing power supply.

Within a few days, the PVC industry has a limit of trading and a limit of trading, which is really the king's flag of change at the head of the city!

Ministry of Commerce: 5 years of anti-dumping duties on US imports of PA66 chips

The editor learned that the latest news on October 12, the Ministry of Commerce will continue to impose anti-dumping duties on imported PA66 slices originating in the United States for a period of 5 years. The new rates are as follows: Ascend Functional Materials Ltd. -31.4 per cent; Invista LLC -25.2 per cent; Other United States companies -37.5 per cent.

For PA66 anti-dumping tax increase, the domestic is not alone this year's case:

On October 12, 2009, the Ministry of Commerce issued Announcement No. 79 of 2009--

Decided to impose anti-dumping duties on imports of PA66 chips originating in the United States, Italy, Britain, France and Taiwan. The anti-dumping duty rates are 25.2-37.5 for American companies, 5.3-20.9 for Italian companies, 20.9 for British companies, 20.9 for French companies and 20.9 for Taiwan companies. The implementation period is 5 years from October 13, 2009.

On October 12, 2015, the Ministry of Commerce issued Announcement No. 37 of 2015--

Decided to continue to impose anti-dumping duties on imports of polyamide-6, 6 chips originating in the United States, Italy, France and Taiwan from October 13, 2015, and the implementation period is 5 years. The anti-dumping measures against imports of polyamide-6, 6 chips originating in the United Kingdom have expired.

On October 12, 2020, in response to the application of the polyamide-6, 6 chip industry in mainland China, the Ministry of Commerce issued Announcement No. 42 of 2020--

Decides to conduct a final review investigation of the anti-dumping measures applicable to imports of polyamide-6, 6 chips originating in the United States as of October 13, 2020. The anti-dumping measures against imports of polyamide-6, 6 chips originating in Italy, France and Taiwan have expired.

The editor believes that the Ministry of Commerce will investigate the possibility of dumping and damage to the PA66 slice industry in mainland China by imported PA66 slices originating in the United States if the anti-dumping measures are terminated.

Let's take a look at some plastic raw materials market trend analysis ~

1. general plastics market

PP: Continuation of weak tone

● Influencing factors ●

Futures continued to decline, suppressing the in stock market atmosphere, driving in stock prices to continue to fall, some petrochemical factory prices down, traders continue to lower the focus of quotations, the market wait-and-see sentiment increased, the downstream continued to receive goods cautiously, the real deal flat.

● Aftermarket Forecast ●

It is expected that today's domestic polypropylene market is weak finishing. Taking the price of wire drawing in East China as an example, the mainstream price of wire drawing is expected to be 9800-9900 yuan/ton.

PE: Price Decline

● Influencing factors ●

Some petrochemical plants continued to raise their stock prices, but the market prices fell. North China fell 150-250 yuan/ton linearly, high pressure fell 100-200 yuan/ton, low pressure fell 50-100 yuan/ton, wire drawing and injection molding fell 100 yuan/ton, and membrane materials fell 100-150 yuan/ton;

The linear part of East China region fell 150-300 yuan/ton, the high-pressure part fell 100-200 yuan/ton, and the low-pressure wire drawing, injection molding, membrane material and hollow part fell 50-100 yuan/ton;

South China region linearly fell 150-250 yuan/ton, high pressure fell 100-200 yuan/ton, low pressure wire drawing, hollow and membrane materials fell 100 yuan/ton.

Linear futures low open volatility repeatedly, petrochemical most stable, individual down or the introduction of batch policy, players trading confidence frustrated, holding the goods business report continues to loosen, the terminal factory more cautious wait-and-see, real price focus on negotiations.

● Aftermarket Forecast ●

It is expected that the domestic PE market price will drop slightly today, and the mainstream price of LLDPE is expected to be 9600-10150 yuan/ton.

ABS: Slightly Lower

● Influencing factors ●

Intraday energy and chemical commodities retreat, the mentality of the holders tend to be cautious, the mainstream market part of the negotiations loose, but small and medium-sized downstream factories to avoid the majority of risk, in stock transactions are not good. During the period, some middlemen prices were lower than first-hand merchants.

ABS mainstream ex-factory prices stabilized, manufacturers can sell in stock resources tight.

● Aftermarket Forecast ●

Short-term focus on just need to purchase rhythm changes, it is expected that the ABS market will be a narrow finishing operation in the near future.

PS: Falling prices

● Influencing factors ●

Raw material styrene prices fell, so that PS prices under pressure, and drag down the market trading atmosphere, downstream buying follow-up is not good.

● Aftermarket Forecast ●

Raw material styrene weak adjustment trend or continue, so that PS price pressure, some grades of supply tight or limit the decline, but the new production will land or form a drag on the price, the short-term PS price is expected to be weak adjustment.

PVC: price down

● Influencing factors ●

Upstream price offer, futures prices fell, but the market circulation of in stock is still not much, traders offer to follow the futures down. Terminal downstream low just need to replenish, intraday trading is light.

● Aftermarket Forecast ●

PVC fundamentals have not changed much in the near future, and the futures price trend has a more obvious impact on the in stock. It is expected that the short-term domestic PVC market will fluctuate, and the SG-5 oscillation range in East China will be 13600-14000 yuan/ton.

EVA: high finishing

● Influencing factors ●

Hard material offer slightly softer, soft material prices are relatively firm. Traders follow the market offer, inventory pressure is not great. The demand of terminal enterprises is flat, and the enthusiasm for entering the market is weak.

● Aftermarket Forecast ●

The fundamentals of market supply and demand have not changed much. EVA prices are expected to be adjusted in a narrow range, and VA18 content foaming materials may be 26500-29,000 yuan/ton. Pay close attention to the recent production scheduling of enterprises and the impact on EVA prices in the future.

Source: Looking for Plastic Viewpoint

Disclaimer: The above content is reproduced from WELINK Plastic, and the content does not represent the position of this platform.