News

New production capacity continues to release PP supply pressure in 2019

Release time:

2018-12-17 15:34

On December 11, 2018, Dalian Hengli Petrochemical issued a message that it planned to start the operation on December 15 and the normal decompression and other units were planned to start the operation. As soon as this news came out, it aroused the attention of the industry to the future production of the device. It is understood that the new PP production capacity in 2018 is 1.05 million tons. As shown in the table above, CNOOC Shell, Yan'an Energy Chemical, and Jiutai Energy are also planned to put into production. But put into production in 2019

On December 11, 2018, Dalian Hengli Petrochemical issued a message that it planned to start the operation on December 15 and the normal decompression and other units were planned to start the operation. As soon as this news came out, it aroused the attention of the industry to the future production of the device.

It is understood that the new PP production capacity in 2018 is 1.05 million tons. As shown in the table above, CNOOC Shell, Yan'an Energy Chemical, and Jiutai Energy are also planned to put into production. However, the production of the plant in 2019 is expected to be larger than in 2018. With the continuous release of domestic plant production capacity, the market supply pressure will gradually increase, and the market supply pattern of polypropylene may change.

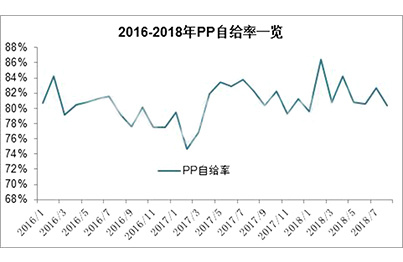

First of all, in terms of self-sufficiency rate, with the continuous increase of domestic polypropylene plant capacity, petrochemical production enterprises have continuously enriched their product types and continuously improved the self-sufficiency rate of raw materials. As shown in the figure, the monthly self-sufficiency rate of PP in 2018 is on average 81.94, slightly higher than 80.71 in 2017. It is estimated that the self-sufficiency rate of PP raw materials in 2018 will increase by 1.52 compared with 2017. At present, China still needs to import 40-500000 tons of polypropylene from abroad every month, but the import of polypropylene shows an increasing trend of raw materials, such as impact copolymerization, pipe, random copolymerization, etc. Due to the homogenization of raw materials and the falling price, the price advantage of imported polypropylene is no longer obvious, the import volume of general polypropylene decreases, and the import dependence decreases year by year. It is estimated that the import dependence of PP will be below 20% in 2018.

Secondly, in terms of apparent consumption, China's apparent consumption has shown a trend of increasing year by year in recent years. Affected by the macro-economy, the apparent consumption growth rate of PP slowed down in 2016. Affected by the Sino-US trade war in 2018, the export orders of domestic products enterprises were affected. Since September, the demand for raw materials in downstream factories has gradually weakened. Petrochemical production plant in the third quarter of 2. 2018 centralized maintenance, although to some extent to ease the supply pressure, but the market by futures and macro constraints, demand performance is still poor. The growth rate of polypropylene apparent consumption is still slow in 2018, and the apparent consumption is expected to be around 23.5 million tons in 2018. In 2018, polypropylene continued to accommodate the gap left by the contraction of the recycled material market, and apparent consumption increased slightly, with an expected increase of about 3.29 percent.

In 2019, more polypropylene plants will be put into production, with a planned production capacity of 6.05 million tons. Given the possibility of delay in the production of plants in the fourth quarter, more than half of the production capacity may be lost. In contrast, new capacity in 2019 is still greater than in 2018.

(responsible editor: China plastic network)